For example, a toymaker’s direct supplies would include the plastic, cloth, and electronic parts used to assemble its toys. As they have zero price of sales, this won’t be visible on revenue statements. Now, let’s see how cost of gross sales is calculated when making use of the three inventory price strategies. It prevents inaccurate or excessive values, making it much simpler to calculate price of gross sales, profitability, and taxes. In this methodology, the common price of all purchased or manufactured inventory is used, whatever the buy or production date. Cost of gross sales, or value of products sold (COGS), may be daunting when working a business.

- Commerce terms and reductions can affect the online purchase value, influencing the price of sales.

- While looking at COGS over time supplies clear projections of progress and sustainability of the enterprise, it doesn’t provide the chance to get granular.

- Cost of goods sold (COGS) represents the direct prices of manufacturing or buying the products a company sells, corresponding to supplies and labor.

Direct Labor

The terms ‘profit and loss account’ (GAAP) and ‘income statement’ (FRS) ought to mirror the COGS information. Calculating Cost of Items Bought (COGS) accurately is significant for profitability analysis however can turn out to be troublesome when managing fluctuating prices and large inventories. Artificial intelligence simplifies this course of by automating cost monitoring, figuring out pricing anomalies, and forecasting future modifications. The gross profit helps determine the portion of revenue that can be utilized for working bills (OpEx) in addition to non-operating expenses like curiosity expense and taxes.

Select A Product To Get Began

Accurate tracking of those materials requires strong stock administration methods to make sure precise recording and valuation. Beneath Worldwide Financial Reporting Standards (IFRS), inventory should be reported at the lower of cost or net realizable value, making correct price measurement crucial. Many firms use software to streamline tracking and reduce discrepancies that might impression monetary statements. Study to precisely calculate the worth of sales by understanding its components, stock techniques, and valuation strategies for better financial insights. 💼 If you run a enterprise — whether it’s a retail store, ecommerce web site, or service-based company — understanding your value of gross sales is crucial.

For Product-based Corporations (cost Of Products Bought Or Cogs)

When you buy in more goods than you promote, it might look as though you could have made a loss and have no tax to pay. However there’s an additional adjustment to make in your accounts to mirror that you just nonetheless own some of the gadgets. COGS represents the actual prices incurred to provide and promote goods, so it ought to all the time be a optimistic worth or zero.

These prices are sometimes allotted to products utilizing a predetermined rate based mostly on activity measures like direct labor hours or machine hours. Adhering to usually cost of sales equation accepted accounting principles (GAAP), businesses should guarantee overhead allocation strategies are consistent and reflect actual useful resource consumption. Common evaluation of those rates is critical to maintain up relevance and modify for adjustments in manufacturing or cost structures.

Working A Business

Cost of gross sales represents all the costs that go into offering a service or product to a customer. Figuring Out how a lot it prices to serve your clients is prime to making good financial selections, like setting competitive prices and sourcing suppliers. When stock is artificially inflated, COGS will be under-reported, which, in turn, will lead to a higher-than-actual gross profit margin and therefore, an inflated internet income.

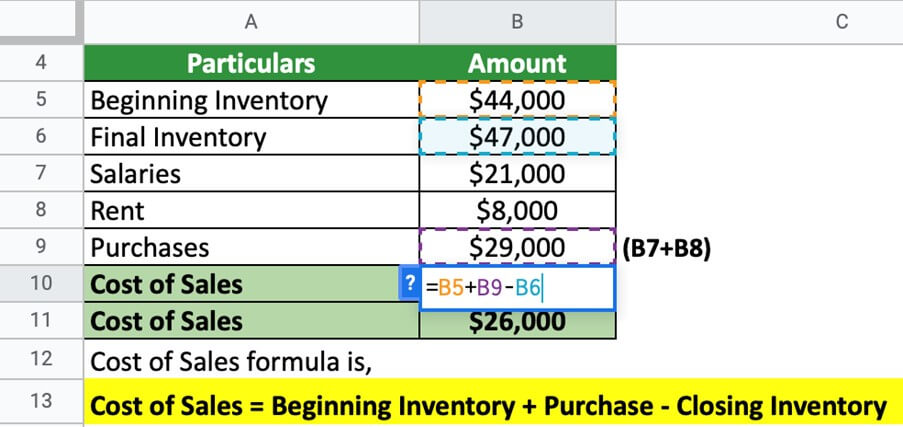

By comparing this figure to the revenue earned, service companies can assess the profitability of particular person projects and make informed decisions about pricing and useful resource allocation. Some COGS-related bills are direct uncooked supplies, direct labor prices, manufacturing overhead, and direct prices of manufacturing. As you probably can see, calculating the worth of sales method is relatively simple, assuming you understand https://www.kelleysbookkeeping.com/ what to include and what to go away out of the calculation. Ultimately, knowing tips on how to calculate the worth of sales is necessary for understanding your business’s gross profit. Direct labor includes wages and benefits paid to staff directly involved in production, corresponding to base wages, payroll taxes, and insurance.

In a producing setting, this would come with meeting line workers and quality management inspectors. According to the Typically Accepted Accounting Principles (GAAP), price of sales is the value of inventory bought throughout any given period. This technique is the opposite of FIFO, the place essentially the most recently manufactured or bought goods get bought first. Throughout periods of inflation, you will promote your gadgets that came at a better value first. Subsequently, the value of price of sales utilizing FIFO will be comparatively lower.